Follow us on :

In the rapidly evolving financial technology industry, FinTech startups are redefining the global financial landscape with innovative solutions, speed, and a customer-centric approach. However, as the industry matures and competition intensifies, precise targeting and smarter B2B outreach have become essential for growth.

One of the most effective tools to power this outreach is a banking email list—a curated contact list of verified professionals in the banking and finance industry that helps FinTech companies engage directly with the right people, at the right time.

A banking industry email list is a curated, verified database of contact information for professionals working in the banking and financial services industry. These lists typically include key details such as:

Full name

Email address

Job title/role

Department or division

Company/bank name

Location (city/state/region)

Phone number (optional)

Years of experience or seniority level

Whether you’re targeting bank executives, loan officers, compliance managers, or IT decision-makers, a verified banking email list enables marketers to segment their audience precisely and deliver highly targeted, relevant outreach campaigns.

The banking email list typically includes professionals in roles such as:

• Loan officers and credit analysts

• Risk and compliance managers

• Heads of digital innovation and banking

• Chief technology and Chief financial officers (CTOs and CFOs)

• Senior executives from private, commercial, and retail banks

FinTech companies use these lists to drive strategic outreach, create partnerships, and run performance-driven campaigns across email, LinkedIn, and ABM channels.

The challenges are varied and impact multiple areas of growth:

🔹 Complex Sales Cycles: Navigating long decision-making processes involving multiple banking stakeholders slows progress.

🔹 Limited Access to Decision-Makers: Without accurate contact data, connecting with key banking professionals becomes a guessing game.

🔹 Regulatory Restrictions: Compliance rules limit broad, untargeted outreach efforts, increasing the difficulty of reaching prospects.

🔹 High Competition: Many startups offer similar solutions, making targeted, personalized messaging essential to stand out.

🔹 Wasted Marketing Spend: Generic campaigns often miss the mark, leading to low engagement and poor ROI.

Targeted outreach with verified banking contacts helps FinTech startups bypass these barriers, enabling precise connections, faster engagement, and better conversion rates.

Here are the top advantages of leveraging a verified banking email list for FinTech B2B outreach:

Instead of relying on cold calls or generic ads, FinTech marketers can utilize a banking email address list to directly reach relevant contacts, such as compliance officers, IT heads, or product managers, via email or LinkedIn.

A clean and segmented banking industry email list shortens the sales cycle by reducing guesswork. Whether you’re offering digital wallets, lending APIs, fraud detection tools, or KYC automation, these lists help match solutions with demand quickly.

Outreach campaigns built on a finance industry mailing list typically see better open and response rates due to relevance and personalization. You avoid high bounce rates and improve sender reputation.

Need to reach credit unions, retail banks, or Tier 1 commercial banks? A segmented banking contact database allows that flexibility, supporting both international and niche campaigns.

Reputable lists are GDPR- and CCPA-compliant. This ensures your outreach respects privacy laws and avoids block listing risks, crucial for long-term brand building in the financial services space.

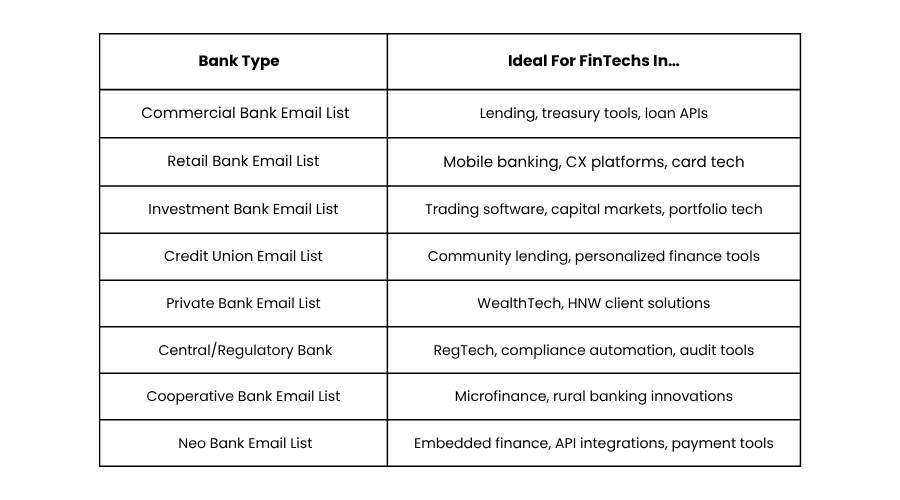

Different FinTech solutions need different banking partners. Here’s a quick overview of the most common banking email list types:

The real power of a banking mailing list lies in how you use it. Below are proven strategies:

Not all lists are created equal. Here’s what FinTech startups should expect from a premium banking mailing list:

A robust industry email list based on verified sources enables targeting with clarity and confidence.

This year, several trends are converging that make 2025 the perfect time to invest in a verified banking email list:

🔷 Embedded Finance Is Exploding:

Banks are collaborating with FinTech’s for payment processing, lending APIs, and more. A robust banking industry mailing list enables you to capitalize on these opportunities.

🔷 Personalization Outperforms Paid Ads:

Generic Google Ads are yielding lower returns. However, targeted email campaigns to a curated banking industry email list yield higher engagement and lead-to-close ratios.

🔷 Regulatory Complexity Is Driving Demand:

As compliance burdens grow, banks actively seek solutions to automate workflows and reduce risk. If you offer RegTech or fraud prevention solutions, you need direct access to decision-makers, made possible with the right banking email contacts.

In 2025, banking email lists are more powerful thanks to new technologies:

Ensures up-to-date, accurate data by automatically validating and enriching contact information

Prioritizes verified contacts most likely to convert

Guarantees transparent consent tracking for full GDPR and CCPA compliance

Combines role and activity insights for highly personalized outreach

Enables real-time syncing for seamless campaign execution

Supports segmentation by bank type, region, and seniority for targeted messaging

At CampaignLake, we specialize in premium banking industry email lists tailored for startups targeting financial services institutions. Our lists are:

• Lists scraped from the web or outdated databases

• No GDPR or CCPA compliance documentation

• No sample data or deliverability guarantees

• Poor segmentation or generic contact fields

FinTech startups operate in a high-stakes, regulated environment where cutting through the noise is essential. To grow, they must connect directly with key decision-makers in banking. A verified Banking Industry Email List offers a cost-effective way to enable personalized, compliant outreach that drives results. In 2025, when precision, trust, and timing matter most, CampaignLake helps you reach the right professionals with accuracy and impact.

Get your verified banking email list today—start connecting, not guessing.

FinTech startups, B2B marketers, sales teams, and SaaS companies targeting banks can greatly benefit from using a banking email list to connect with decision-makers and reduce their sales cycle time.

They typically include bank executives, compliance managers, loan officers, product innovation leads, IT heads, and other senior professionals in the banking industry.

Ideally, every 60–90 days. Using outdated lists can increase bounce rates and reduce deliverability. Providers like CampaignLake update their lists regularly to maintain accuracy.

Yes, if you’re sourcing from a legitimate provider. CampaignLake, for example, ensures full GDPR and CCPA compliance by verifying all records through permission-based data practices.

Absolutely. A well-structured banking contact database enables segmentation based on role, location, institution size, and other factors, providing you with complete control over your targeting strategy.

Most providers offer export-ready formats compatible with tools like Salesforce, HubSpot, Mailchimp, and others. Always ensure the data structure aligns with your CRM’s import format.

When combined with personalized messaging, verified lists can yield response rates 2–3 times higher than those of generic outreach. You also minimize email bounces and maximize lead conversion.

Yes. Reputable vendors, such as CampaignLake, offer sample data or trial campaigns, allowing you to evaluate deliverability and data quality before committing.

Banking email list target bank professionals; finance email list cover a broader financial sector. Use banking lists for banks, finance lists for wider financial outreach.

David Jax is a seasoned B2B marketing strategist specializing in targeted email lists and data-driven outreach solutions. With years of experience in lead generation and sales enablement, David helps businesses connect with the right audiences through precision-based marketing tactics. His ability to translate complex data into clear, actionable strategies has made him a trusted voice in the B2B space. Outside of his writing, David is passionate about exploring emerging trends in marketing technology and refining techniques that maximize campaign performance. He regularly contributes to leading industry blogs and enjoys sharing insights that help marketers turn data into growth.