Follow us on :

In today’s fiercely competitive financial marketing landscape, reaching the right audience with precision is no longer optional — it’s essential. For businesses targeting credit unions, a verified credit union email list is more than just a collection of contacts; it’s a strategic asset that enables personalized, targeted outreach. Unlike generic approaches, a curated industry email database ensures your message connects with the right decision-makers at the right time, maximizing engagement and ROI.

Whether you’re promoting fintech solutions, compliance services, or specialized software, an industry mailing list offers unmatched efficiency. By leveraging accurate and up-to-date contact information, your campaigns can cut through the noise, foster stronger relationships, and drive measurable results in less time. This is why a verified email list by industry is the foundation of successful financial outreach.

A verified credit union email list is a targeted, authenticated contact database of information for professionals and decision-makers working within credit unions across a specific region, such as the United States or California. These lists may include CEOs, CFOs, marketing heads, IT directors, compliance officers, and other key personnel.

A verified list means the contact list has been checked and validated for accuracy. This typically includes:

Unlike generic email databases, a verified credit unions contact list assures that your campaigns are reaching real, interested recipients.

From driving targeted engagement to improving ROI and compliance, here are the top reasons why a verified credit union email list can transform your marketing strategy.

When you have access to a segmented and verified credit unions list, you’re not wasting resources. Instead of casting a wide net and hoping for leads, you’re speaking directly to professionals who are relevant to your business.

For example:

Cybersecurity firms → IT heads

Compliance trainers → Compliance officers

CRM vendors → Marketing heads

With the credit union CEO email list, you can even reach top-level decision-makers for big-ticket offerings like directors, C-level executives, and presidents. Whether you’re after union executives email list or niche contacts, precision targeting saves time and boosts results.

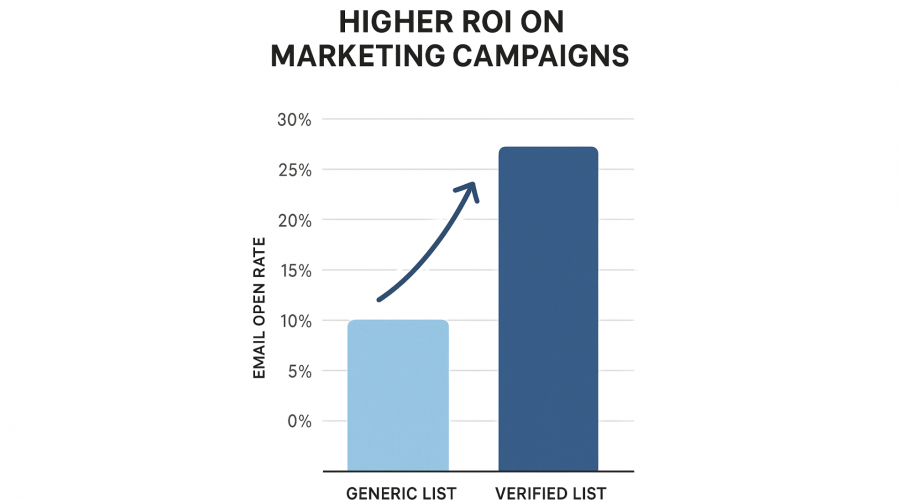

Marketing budgets are always under scrutiny. Investing in a well-researched credit union mailing list increases the likelihood of your outreach being successful. Verified emails reduce bounce rates, increase open rates, and ultimately drive better conversions.

Studies show that personalized email campaigns generate up to 6x more revenue than generic ones. Using a precise and comprehensive list of credit unions, your messaging can be more targeted and relevant, leading to increased ROI.

One of the biggest advantages of using a list of US credit unions is the ability to initiate and maintain long-term business relationships. Credit union decision makers value partners who understand their mission.

Verified contact data helps you stay connected:

Over time, this builds credibility and positions you as a trusted vendor with access to a qualified union executives email list.

When you’re consistently visible to key people in the industry—thanks to a robust credit union email list—your brand gains recognition. As professionals see your name and offerings across multiple touchpoints, your company begins to be seen as an expert in the space.

With a verified list of credit unions in the US, you can:

State or region

City size

Local regulations

Assets under management (AUM)

This enables hyper-targeted campaigns that resonate with specific credit union segments.

One of the frustrations of email marketing is email bounce—when emails cannot be delivered due to incorrect or outdated addresses. This issue is largely eliminated when using a verified credit union email database.

Such lists are often:

This leads to improved deliverability, which in turn:

By using validated credit union email addresses, your emails are more likely to land in inboxes.

Reaching the right audience often depends on location—especially when promoting regional events, localized services, or compliance-based solutions. A verified credit union email list enables precise geographical targeting, helping you focus your outreach where it matters most.

For example:

Suppose you’re hosting a seminar in California or launching a product tailored to that region. In that case, a list of credit unions in California allows you to connect directly with institutions operating within that state.

With geographic segmentation, you can tailor messaging based on:

This kind of hyper-targeted approach enhances engagement, ensures relevance, and helps you align your offerings with the specific needs of credit unions in particular locations.

Not all credit unions are the same. Some focus on small communities, others operate at a national level. A verified credit union banks list helps you segment your audience based on:

This helps you customize credit union outreach strategies. Personalized emails see a 29% increase in open rates and a 41% boost in click-through rates compared to generic emails.

Time is money. Instead of spending countless hours researching contacts, you get an instant contact database of ready-to-use leads. With a reliable list of credit unions, your sales team can allocate more time toward closing deals.

A good credit union email list provider will offer:

This fast-tracks your lead generation efforts without compromising on quality.

Your email list doesn’t have to be used for email only. The contact data can power multi-channel marketing strategies including:

The comprehensive nature of a good credit union executives email list allows your team to maximize reach across digital and offline channels.

Professional email list providers follow strict protocols to ensure data compliance with international privacy regulations such as:

Using a compliant list of credit unions in the US safeguards your business from penalties and maintains ethical standards in communication.

Here are a few types of businesses and organizations that can leverage a verified credit union list:

Whether you’re offering products or services, the ability to connect directly with the right credit union decision makers is invaluable.

When it comes to connecting with credit union decision-makers, CampaignLake goes beyond simply providing email lists—we deliver high-quality, verified data that drives results. Here’s why businesses trust us for credit union email marketing:

Accurate and Up-to-Date Contacts: Our verified credit union email lists include current information for CEOs, CFOs, IT heads, compliance officers, marketing leaders, and other key personnel, ensuring your outreach reaches the right audience.

Customizable Lists: Filter and segment your list by region, institution size, job title, charter type, and more to target prospects with precision.

Seamless CRM Integration: Instantly import your credit union contact list into popular CRMs like Salesforce, HubSpot, Microsoft Dynamics, or marketing automation platforms for smooth workflow management.

Compliance You Can Trust: All our lists follow GDPR, CAN-SPAM, and CCPA regulations, keeping your marketing campaigns fully compliant and ethical.

Multi-Channel Outreach: Leverage your credit union email database for email campaigns, phone outreach, direct mail, LinkedIn marketing, or event invitations—maximizing engagement opportunities.

Expert Support: Our team guides you in optimizing targeting strategies, ensuring your campaigns reach the right people with the right message at the right time.

With CampaignLake, you’re not just accessing a list—you’re building meaningful connections with the credit union community and boosting your marketing ROI.

In the financial sector, particularly among community-driven institutions such as credit unions, relationship-building and trust are crucial. A verified credit union email list enables your organization to cut through the noise and deliver targeted, personalized, and relevant messages to the people who matter most.

From higher ROI to faster lead generation and brand growth, the benefits are clear. If you’re ready to take your financial marketing strategy to the next level, investing in a verified credit union database is a smart move.

Start building your relationship with the credit union community—one verified email at a time.

A verified credit union email list is a carefully curated database containing accurate and up-to-date credit union contact information. It includes details like full names, job titles, direct emails, phone numbers, and addresses of key decision-makers in credit unions.

Using a credit union mailing list ensures your campaigns reach the right professionals. It improves email deliverability, boosts open and click-through rates, reduces bounce rates, and increases overall ROI for financial marketing campaigns.

A verified credit union contact list can include CEOs, CFOs, IT directors, compliance officers, marketing heads, and branch managers—any decision-makers who influence purchases or partnerships in credit unions.

A verified credit union email database is regularly updated and validated. Real-time verification ensures emails are correct, phone numbers are active, and all contacts comply with data protection laws like GDPR, CAN-SPAM, and CCPA.

Yes. A credit union email list allows you to filter contacts by state, city, size, or assets under management (AUM). This makes it easier to run region-specific marketing campaigns for credit unions.

A verified credit union mailing list helps with:

Precise targeting of the right decision-makers

Improved engagement and email open rates

Reduced bounce rates and better deliverability

Compliance with privacy laws

Higher conversions and ROI

Yes. A credit union contact list can be exported in formats compatible with CRMs like Salesforce, HubSpot, and Microsoft Dynamics. This allows seamless integration and easier management of leads for your email campaigns.

Yes. Top credit union email lists follow GDPR, CAN-SPAM, and CCPA rules. This ensures your outreach is compliant, ethical, and safe from penalties.

A verified credit union contact list provides ready-to-use, accurate leads. It helps your sales and marketing teams connect directly with the right decision-makers, generate more qualified leads, and speed up the sales process.

Businesses that can benefit include fintech companies, IT firms, marketing agencies, consultants, training and compliance firms, HR agencies, credit reporting agencies, and software vendors. A credit union mailing list helps these organizations reach key decision-makers efficiently.

David Jax is a seasoned B2B marketing strategist specializing in targeted email lists and data-driven outreach solutions. With years of experience in lead generation and sales enablement, David helps businesses connect with the right audiences through precision-based marketing tactics. His ability to translate complex data into clear, actionable strategies has made him a trusted voice in the B2B space. Outside of his writing, David is passionate about exploring emerging trends in marketing technology and refining techniques that maximize campaign performance. He regularly contributes to leading industry blogs and enjoys sharing insights that help marketers turn data into growth.